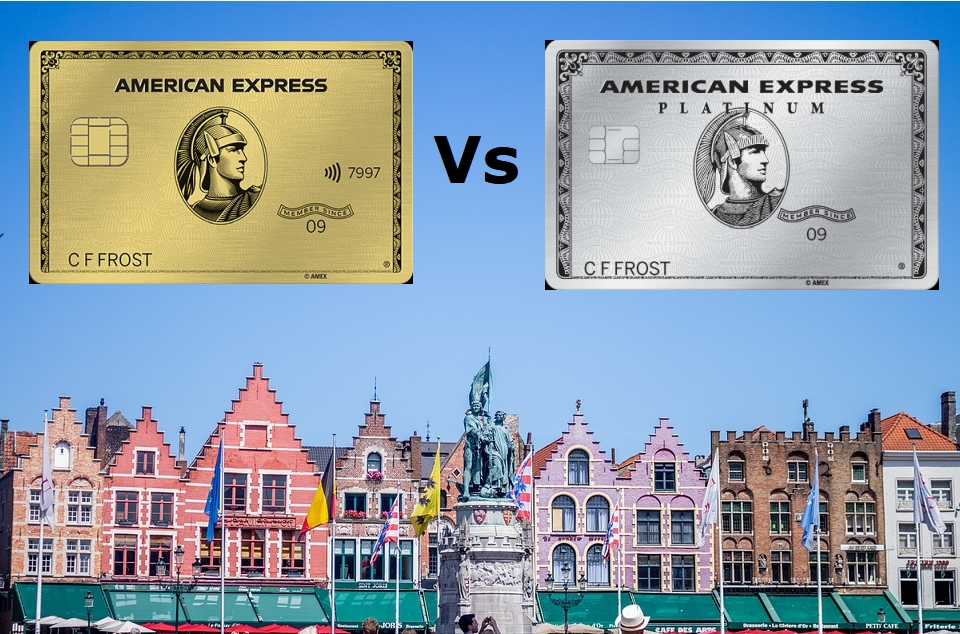

If you are unsure whether you should get Amex Gold or the Amex Platinum or both. We will go through some of the key benefits of Amex Gold and Amex Platinum to decide based on your need.

Today is the last day to apply for the Amex Gold and select the rose gold version, as it’s no longer available starting Jan. 9. Rose Gold is definitely attractive. After that, if you’re approved for the card you’ll get the standard gold version.

Side-By-Side Benefits Comparison

One good thing that Amex did with their Amex Gold is they did consider the main street. Amex Platinum is clearly a travel card with premium benefits. Lets take a look at their key benefits with side-by-side comparison.

Amex Gold Key Benefits

As you can see, Amex did consider some of the common categories such as 4X US Supermarket and 4X US Restaurant in their newly launched Amex Gold. On top of that, $120 Dining credits. This is how it works, $10 in statement credits monthly when you pay with The Gold Card at participating partners. It includes Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, and participating Shake Shack locations. Adding Grubhub and Seamless is great as it opens up a whole lot of restaurants that you can order online. If you don’t have Grubhub account, open now and get $12 after first purchase.

- Earn 40,000 Membership Rewards® Points after you spend $2,000 on eligible purchases with your new card within the first 3 months.

- 4X Membership Rewards® points at US restaurants.

- Earns 4X Membership Rewards® points at US supermarkets, on up to $25,000 per year in purchases.

- 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- Start dining with Gold this month! Earn up to $10 in statement credits monthly when you pay with The Gold Card at participating partners. This can be an annual savings of up to $120. Enrollment required.

- Enjoy perks while you fly. Feel free to check your bags or enjoy an in-flight meal on us. Select one qualifying airline and then receive up to $100 per calendar year in statement credits when incidental fees are charged by the airline to your American Express® Gold Card account.

- $250 Annual Fee

Learn More on the Terms of Amex Gold

Amex Platinum Key Benefits

Amex Platinum, is for someone who travels and uses Uber once or twice a month. It becomes beneficial for them to get Amex Platinum and enjoy all the top Travel Perks. Adding Amex Gold will make the Amex Membership Rewards even more beneficial and maximize their reward earnings.

Some of the top Benefits of Amex Platinum Card, Learn More on what additional features that you can get.

- Earn 60,000 Membership Rewards® points after you use your new Card to make $5,000 in purchases in your first 3 months.

- Enjoy Uber VIP status and free rides in the U.S. up to $15 each month, plus a bonus $20 in December. That can be up to $200 in annual Uber savings.

- 5X Membership Rewards® points on flights booked directly with airlines or with American Express Travel.

- 5X Membership Rewards points on prepaid hotels booked on amextravel.com.

- Enjoy access to the Global Lounge Collection, the only credit card airport lounge access program that includes proprietary lounge locations around the world.

- Receive complimentary benefits with an average total value of $550 with Fine Hotels & Resorts. Learn More.

- $200 Airline Fee Credit, up to $200 per calendar year in baggage fees and more at one qualifying airline.

- Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue on your Platinum Card®. Enrollment required.

- $550 Annual Fee

Learn More on the Terms of Amex Platinum.

Conclusion

If you are an average spend person with travel plans just for vacations without complicating with multiple cards, then Amex Gold is a clear winner. If you travel for business or more frequently then Amex Platinum will definitely give value for their benefits. Combining these two will make your membership rewards even more powerful with valuable business/First class air travel redemptions.

Earn 60,000 Bonus Points

Earn 60,000 Bonus Points

Leave a Reply